Fashion

Ozempic is now boosting sales for smaller-sized clothes, fashion executives say

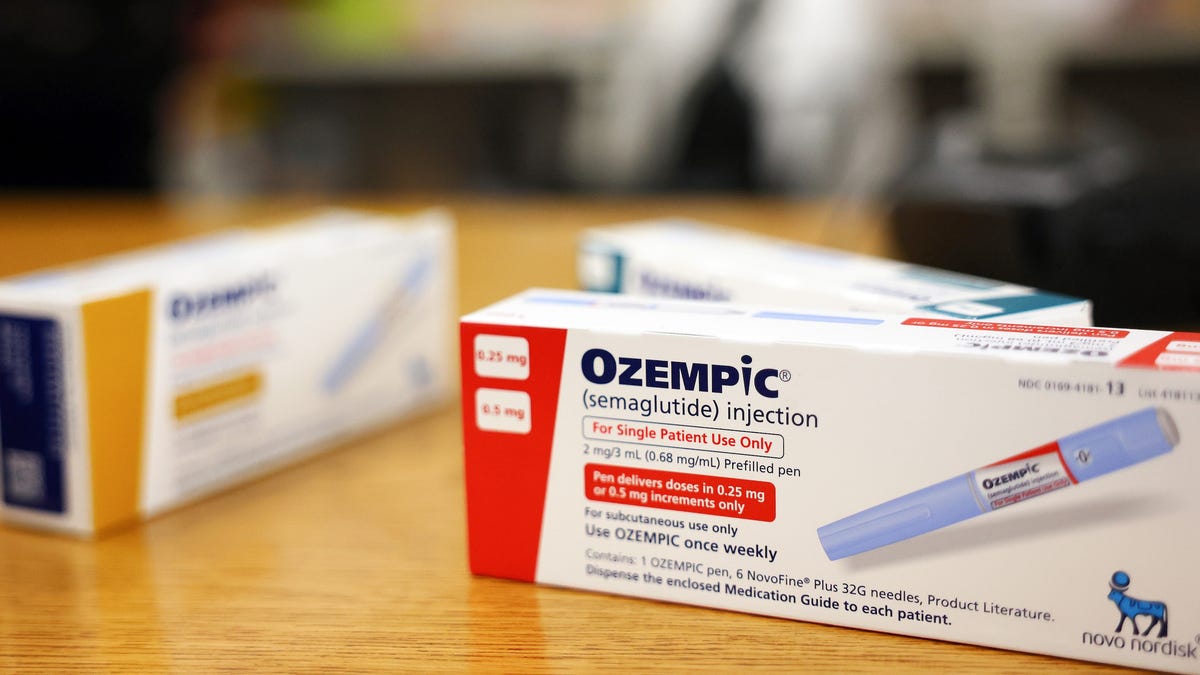

In another ripple effect on the economy, Ozempic and other weight loss drugs are boosting sales of smaller-sized clothes.

According to several clothing brands, customers who have recently lost significant weight are now looking to downsize their wardrobes.

Lafayette 148 CEO Deirdre Quinn told the Wall Street Journal that 5% of their customers are buying new clothes because of weight loss. And Rent the Runway CEO Jennifer Hyman told the outlet that more customers are switching to smaller sizes than ever before in the company’s 15 year history. The executives noted that they couldn’t say for certain that weight loss drugs are the direct cause of these new trends.

In addition, some customers who have lost weight are now experimenting with new styles.

Maggie Rezek, 32, lost 60 pounds on semaglutide — the active ingredient in Ozempic and Wegovy. She told the Wall Street Journal that has bought a new wardrobe after her weight loss.

“Before, I was insecure about my body. Now, I feel like I fit better in clothes. That gives me the confidence to dress up and be more stylish.” — Maggie Rezek

This is just one example of how diabetes and obesity medications known as GLP-1s have been impacting the economy and consumer behavior.

Skyrocketing demand for GLP-1s has transformed Ozempic maker Novo Nordisk and Eli Lilly, the producer of Zepbound, into the largest pharma companies by market cap in the world.

Morgan Stanley analysts anticipate the global market for GLP-1s will reach $105 billion by 2030, up from a previous projection of $77 billion. The investment bank also expects the adoption of these drugs to reach about 31.5 million people in the U.S., or about 9% of the nation’s population, by 2035.

Beyond that, analysts expect the slimming drugs will help boost the fitness industry and reshape the food sector.

Walmart U.S. CEO John Furner said the company is already noticing changes in consumer behavior that he’s attributed to the drugs. He told Bloomberg in October that, in comparison to the general population, users are buying fewer things.

Both chief executives at Novo Nordisk and Eli Lilly have said that they have received calls from food executives for advice regarding the growing popularity of these treatments.