Tech

Arm Holdings Takes Aim at Intel and PC Market. Time to Buy the Stock?

Arm Holdings (NASDAQ: ARM) has long been associated with smartphones, and for good reason. Its architecture forms the basis of how central processor units (CPUs) work, and its technology is found in nearly every smartphone on the planet.

The company recently jumped into another market, with Arm CEO Rene Haas saying that the company plans to capture 50% or more of the Windows-based personal computer (PC) market within five years through a new batch of computers being developed that are based on Arm’s technology.

Let’s look at how big of an opportunity this is and whether this makes the stock a buy.

From smartphones to PCs

Arm has long dominated the smartphone market, and that is not going away. Instead of selling its own chip, the company licenses its architecture to other companies to create their own Arm-based chips. It gets an upfront fee as well as per-unit royalties based on the number of chips shipped using its designs. The more smartphones that are shipped, the more revenue the company takes in.

Last year, there were 1.17 billion smartphones shipped globally, most of which included chips based on Arm’s architecture. What might concern investors though is that the 2023 total was down 3.2%, suggesting the smartphone market may be topping out.

To keep the growth train rolling, Arm management is looking for new revenue streams. One potential source for growth is a segment of the smartphone market focused on artificial intelligence (AI) applications. Unlike prior efforts where Arm only provided abstract designs for others to complete and implement, this time Arm worked with Samsung and Taiwan Semiconductor Manufacturing to provide fully realized designs to prospective clients that are ready to go into production. Management said it did this to help Arm customers get to market faster.

Its latest expansion effort is to take on Intel (NASDAQ: INTC) and Advanced Micro Devices (NASDAQ: AMD) in the PC market. While the PC market is significant, it is small compared to the smartphone market. 2023 PC unit sales were 241.8 million units, down nearly 15% from 2022. 2021 was the highest sales level since 2012 with 348.8 million units sold.

PC sales slumped over the past two years, but they are due for a refresh cycle driven by new AI applications that require additional technologies in the PC to power these applications. Arm plans to be at the center of this new AI PC push, and it got a boost when Microsoft recently announced its newest Windows operating system would now be run on Arm-based Qualcomm chips. Partners such as Dell Technologies and Asus, among others, will also launch AI-ready computers with the new chips, while Microsoft said that new partner devices with Intel and AMD chips will be released at a later time.

While Arm isn’t completely replacing its rivals, this is a good first step to make some inroads into eventually getting to that 50% Windows PC market share. For its part, Morgan Stanley analysts forecast Arm’s share in Windows PC ships will go from 0% in 2023 to 14% in 2026.

Notably, Apple began using its own Arm-based chips in laptops and tablets starting back in 2020 and completely phased out Intel by 2023. Apple makes up around 9% of PC sales.

Is it time to buy the stock?

Arm has some solid tailwinds behind it related to AI. The company should see a boost as smartphone makers look to use its more advanced technology designs in their AI-ready smartphones. In addition, Arm is clearly set to make inroads into the Windows PC market and could look to take some serious share. Going from 0% to 50% market share would be quite an accomplishment, but going from 0% to 100% in Apple computers in a few years shows that these types of share gains can be made quickly. At the same time, AI applications could very well spur a hardware upgrade cycle for both smartphones and computers.

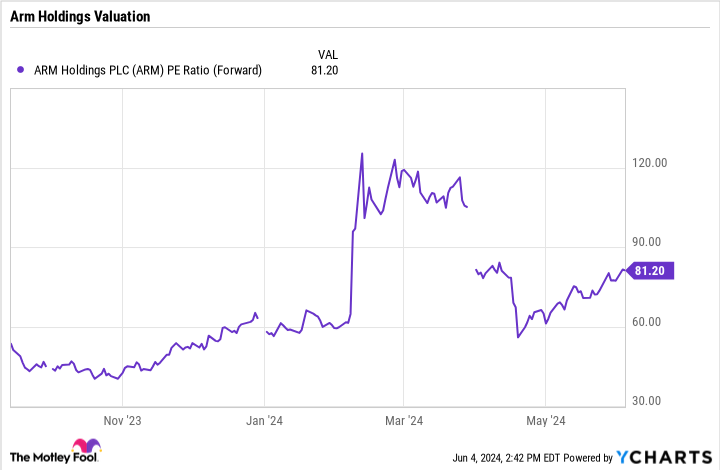

From a valuation perspective, Arm trades at just over 81 times on a forward price-to-earnings (P/E) multiple. That’s not cheap, but it’s worth remembering that its licensing model is extremely valuable and has a long tail. What this means is that it will be generating revenue from its designs today for many years in the future. In fact, nearly half of its royalty income comes from products released between 1990 and 2012. That’s a powerful business model that is worth paying a premium for given the growth in front of the company.

Over the long term, Arm should be a solid investment, given its business model and the tailwinds it is seeing. However, I would likely wait to make any buys on this semiconductor stock when there is a price dip given its elevated valuation at the moment.

Should you invest $1,000 in Arm Holdings right now?

Before you buy stock in Arm Holdings, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Arm Holdings wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $741,362!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 3, 2024

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, Microsoft, Qualcomm, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short August 2024 $35 calls on Intel, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Arm Holdings Takes Aim at Intel and PC Market. Time to Buy the Stock? was originally published by The Motley Fool