Gambling

Availability restrictions and mandatory precommitment in land-based gambling: effects on online substitutes and total consumption in longitudinal sales data – BMC Public Health

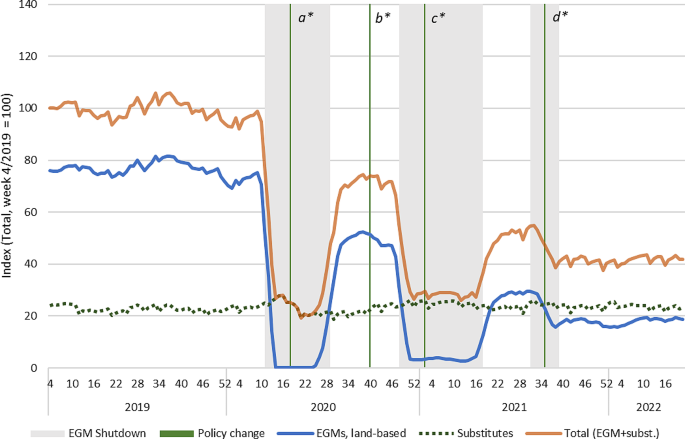

Overall, there was a marked decrease in total revenue from gambling during the overall period (January 2019 – July 2022). The most important decreases coincide with the restrictions on land-based gambling during the first and second waves of Covid-19. Despite increases in revenue following the lifting of restrictions, the overall consumption does not fully recover, and the decreasing trend follows through the entire period of observation (see Fig. 1).

Overall sales of land-based and online gambling in Finland 2019–2022. Total index of revenue and land-based index and online index in relation to total revenue at 4/2019 (Total index = land-based index + online index). Indexed four-week moving averages with week 4/2019 = 100. Policy changes: a) Reduced loss limits for fast-paced online gambling (daily and monthly); b) Return of higher loss limits for fast paced online gambling (monthly); c) Mandatory identification (non-casino EGMs); d) Mandatory precommitment (all land-based EGMs)

Linear regression was fitted for the total revenue index. Altogether five statistically significant events were left in the model. The regression estimates for these gambling restrictions showed statistically significant decrease between 9.2 and 15.0 index points of total revenue (see Table 2).

In the following, we analyse online and land-based sales of different product categories to identify possible product-level substitution effects following the policy changes and availability restrictions.

Lottery-type products

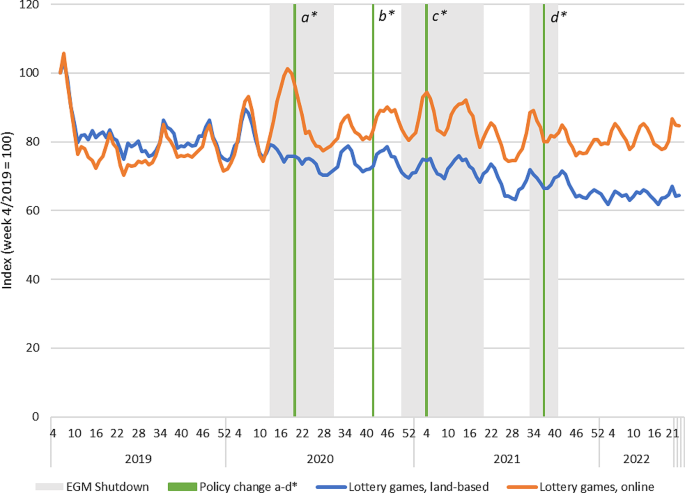

The sales revenue from lottery-type products (lotteries, scratch cards) remained quite constant during the observation period (see Fig. 2). There were no important policy changes particularly targeting this product group. Overall, there is an observable increase in the sale of online lotteries during the first Covid-19 EGM shutdown, but no similar increases during the subsequent shutdown periods. Overall, lottery sales have declined since 2019 both online and offline, although online sales have picked up to a higher extent.

Revenue from lottery-type products in land-based and online channels in Finland 2019–2022. Indexed four-week moving averages with week 4/2019 = 100. Policy changes: a) Reduced loss limits for fast-paced online gambling (daily and monthly); b) Return of higher loss limits for fast paced online gambling (monthly); c) Mandatory identification (non-casino EGMs); d) Mandatory precommitment (all land-based EGMs)

Betting-type products

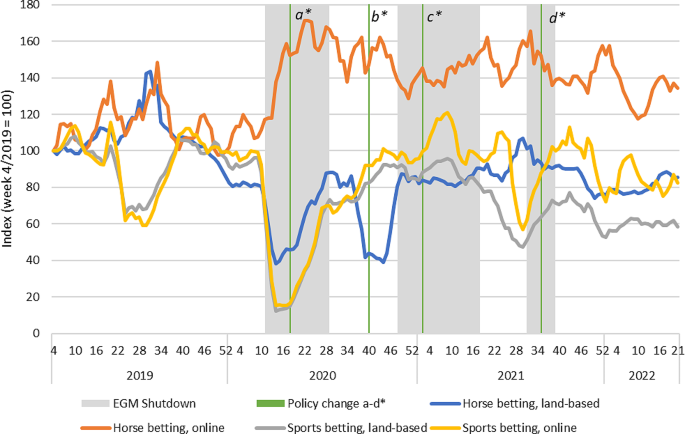

The revenue from betting-type products (sports betting and horse race betting) showed interesting divergence. Online and land-based sports betting have followed very similar sales patterns until late 2020, after which the index of online sales has gradually grown more than that of land-based sports betting (see Fig. 3). The first wave of Covid-19, including important restrictions on major sports leagues, had an important impact on sports betting during spring 2020. Sports betting is also impacted by seasonal effects, as sales tend to decrease over the summer period.

Total revenues of sports and horse betting products in Finland 2019–2022. Indexed four-week moving averages with week 4/2019 = 100. Policy changes: a) Reduced loss limits for fast-paced online gambling (daily and monthly); b) Return of higher loss limits for fast paced online gambling (monthly); c) Mandatory identification (non-casino EGMs); d) Mandatory precommitment (all land-based EGMs).

In terms of horse race betting, a substitution of land-based sales by online sales is more apparent. The first and the second wave of Covid-19 are visible as clear reductions in terms of land-based sales of horse race betting, but also notable increases in online sales. Part of the observable increase in online horse race betting may also be attributed to a substitution of other sports betting. Interestingly, the declining trend of land-based sales appears to have begun already before the first wave of the pandemic, but this trend has been amplified during the Covid-19 restrictions. The longer-term sales trend shows that the substitution of land-based horse race betting by online equivalents has been maintained after the Covid-19 restrictions were lifted. The result indicates that online horse race betting acts as a substitute for land-based horse betting but also for online sports betting more generally during a period of restricted availability.

Most policy changes during the observation period, besides the cancellation of major sporting events in spring 2020, concerned casino-type products. These policy changes do not appear to have had important effects on betting sales, either in terms of reducing or increasing the betting product revenue. However, Veikkaus introduced mandatory identification and a daily purchase limit of 1 500 euros for a popular land-based sports betting product on 1 June 2021. This change was followed by a drop in total sales of sports betting and increase in the sales of horse betting products as the purchase limit and mandatory identification was not applied to land-based horse betting. As the sales of online sports betting also decreased at the same time, the drop in overall sales is likely a result of both seasonal and restriction effects. This lends further support to the finding that horse betting is a substitute for sports betting.

Casino-type products

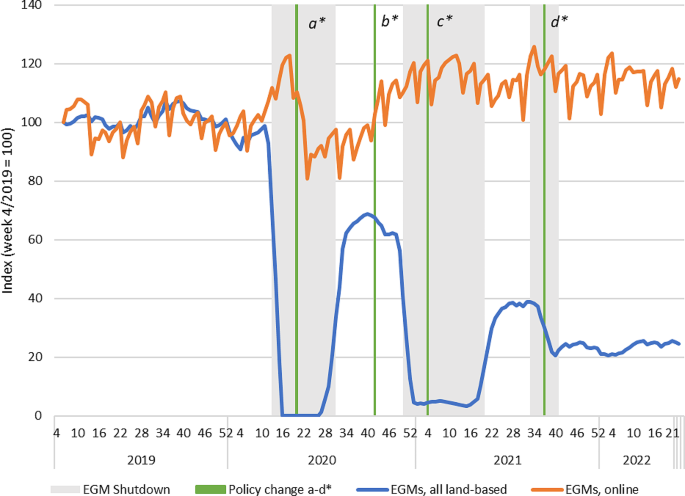

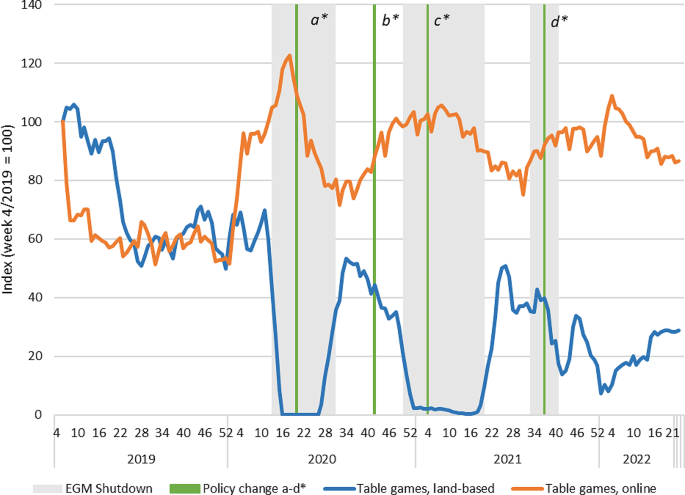

Land-based casino-type products have been the most impacted category both in terms of Covid-19 restrictions and other public health policy measures during the observation period. All sales of land-based EGM and table games ended during the first wave of Covid-19, and most sales were halted during the second wave, except for a few hospital districts with a less pressing pandemic situation. Restrictions during the third wave were shorter and less prevalent. In 2021, the mandatory extension of mandatory identification and precommitment measures to land-based gambling concerned only casino-type products.

During the overall period 2019–2022, land-based sales of both table games and EGMs have declined considerably while online sales have been maintained at close to baseline levels. Land-based sales of EGMs and table games are likely impacted not only by Covid-19, but also other reductions in availability consisting of the reduction of non-casino EGMs and permanent closures of arcades during 2020 and 2021. The availability of land-based casino products thus also decreased permanently over the observation period. The sales trends of casino products, separated by EGMs and table games, are described in Figs. 4 and 5.

Revenue of EGM products in land-based and online channels in Finland 2019–2022. Indexed four-week moving averages with week 4/2019 = 100. Policy changes: a) Reduced loss limits for fast-paced online gambling (daily and monthly); b) Return of higher loss limits for fast paced online gambling (monthly); c) Mandatory identification (non-casino EGMs); d) Mandatory precommitment (all land-based EGMs)

Revenue of table game products in land-based and online channels in Finland 2019–2022. Indexed four-week moving averages with week 4/2019 = 100. Policy changes: a) Reduced loss limits for fast-paced online gambling (daily and monthly); b) Return of higher loss limits for fast paced online gambling (monthly); c) Mandatory identification (non-casino EGMs); d) Mandatory precommitment (all land-based EGMs)

In addition to horse race betting, table game products are the second category with clear observable substitution of land-based sales by online sales. The initial increase in online sales took place already before the pandemic (second week of January 2020) (Fig. 5). This appears to be a seasonal effect as a similar increase with a subsequent drop appears to have also taken place during early January in 2019 and 2021. The overall revenues of table games are also low in comparison to other product categories, making them more sensitive to the impacts of, for example, major events. In 2020, the seasonal increase was nevertheless followed by another increase following the shutdowns of land-based table games, suggesting a substitution effect.

In terms of sales figures, EGM gambling was by far the most profitable product category for Veikkaus before the pandemic. The overall sales trends presented in Fig. 1 therefore follow the developments in the EGM market (Fig. 4). There was no clear substitution of land-based EGM sales with online alternatives, despite Veikkaus operating same game products in both channels. The time series shows an initial 20-point increase in online EGMs during the first wave of Covid-19, but the levels of sales sank below the baseline already before land-based opportunities were reopened. This is likely due to the lowered loss limits for fast online gambling products implemented in May 2020. During the second wave of restrictions, there is no clear substitution effect. However, there is a discernible increasing trend in the revenue of online EGMs after the lockdown commenced. Sales of land-based EGMs have also not recovered after the first wave of Covid-19 and there is a clear declining trend over the full period.

The mandatory precommitment for land-based EGMs and table games outside casinos in September 2021 are also visible as clear drops in terms of the sales of these products. These drops have not been substituted by equivalent rises in terms of online sales. The slight increase in the sales of online table games is more likely attributable to the seasonality effect.

Land-based EGMs and fast-paced substitutes

As the product-level analysis did not show any significant substitution of land-based EGMs by online alternatives, we also analysed whether land-based EGM revenue was substituted by other products than online EGMs. While all gambling products can in theory substitute each other, we only included the closest substitute products (other fast-paced or intensive forms of gambling: online EGMs and bingo, as well as online and land-based scratch cards and table games). However, the aggregate substitute category did not show any further substitution effects than what was observed regarding online and land-based EGMs during the observation period (Fig. 6).

Sales of land-based EGMs and fast-paced substitutes in Finland 2019–2022. Indexed four-week moving averages with week 4/2019 = 100 (Total index = land-based EGM index + online substitutes index, including online EGMs). Policy changes: a) Reduced loss limits for fast-paced online gambling (daily and monthly); b) Return of higher loss limits for fast paced online gambling (monthly); c) Mandatory identification (non-casino EGMs); d) Mandatory precommitment (all land-based EGMs)

This finding suggests that public health-oriented policies such as limited availability and mandatory pre-commitment in one product group can reduce total consumption, and consumption will not necessarily move to alternative products. However, it is important to note that the baseline difference in sales volume of land-based EGMs and the substitutes was significant. Therefore, even observed substitution effects did not fully compensate for the substantial decrease of EGM gambling, and rather translated to a decrease in total gambling losses.