Shopping

Global Blue’s May update shows Europe & Asia Pacific driving tax-free shopping recovery

Global Blue has released its Tax Free Shopping Business Update for May 2024, highlighting a continued recovery in the sector across Continental Europe and Asia Pacific.

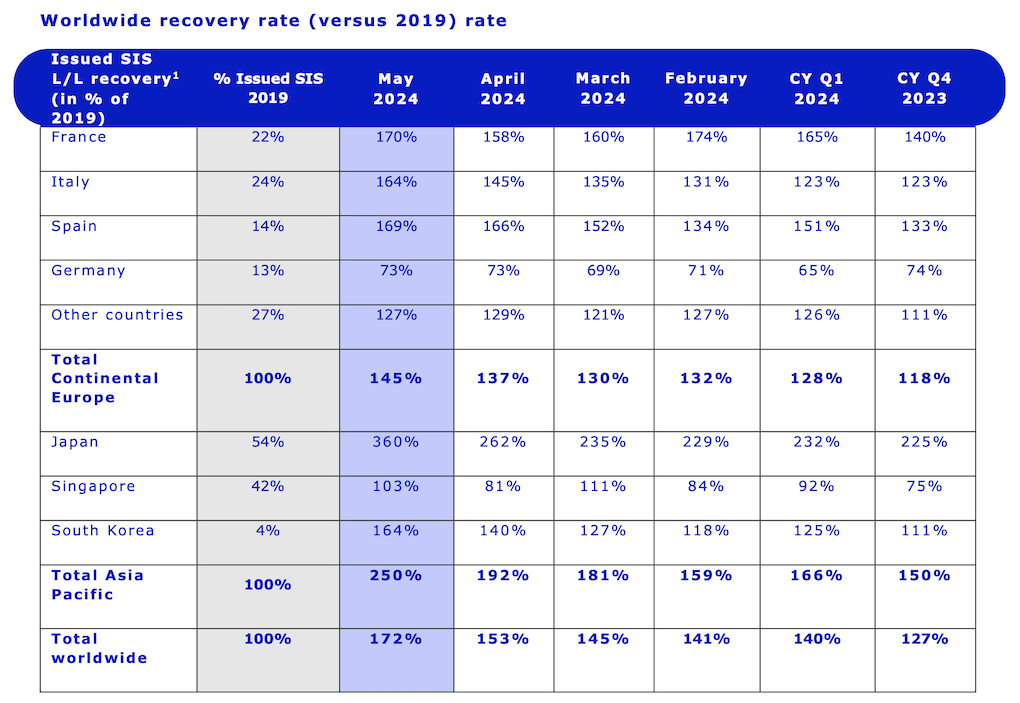

The data shows that issued sales in-store like-for-like recovery reached 172% in May compared to the same period in 2019, an increase from 153% in April and 140% in the first quarter of this year.

The recovery was driven by strong performances across various nationalities. Mainland Chinese shopper recovery continued to accelerate, reaching 132% in May, up from 112% in April and 101% in Q1.

Japan benefitted the most from this acceleration, achieving a recovery rate of 258% in May. This was attributed to a low Japanese Yen, making Japan an attractive shopping destination for Chinese shoppers, who are highly sensitive to exchange rates.

As a result, 64% of worldwide Mainland Chinese shoppers’ sales in-store in May were allocated to Japan, compared to 33% in 2019. Other nationalities also showed accelerated recovery, with rates reaching 210% in May, compared to 187% in April and 177% in Q1.

In Continental Europe, the recovery reached 145% in May, up from 137% in April, with strong performances in France (170%), Spain (169%) and Italy (164%).

The US shopper recovery remained at 307% in May, slightly down from 336% in April. Gulf Cooperation Council (GCC includes Kuwait, Qatar, Saudi Arabia, United Arab Emirates, Bahrain and Oman) shopper recovery surged to 633% in May, driven by the shift in the Ramadan calendar effect (11 March to 9 April).

Meanwhile, Mainland Chinese shopper recovery in Continental Europe softened slightly to 59% in May, down from 68% in April.

In Asia Pacific, the recovery rate reached a record 250% in May, up from 194% in April, fuelled by strong performances in Japan (360%) and South Korea (164%). Travellers from Hong Kong and Taiwan led the recovery, reaching 705% in May, up from 517% in April.

Northeast Asia (Japan and South Korea) travellers followed, with a recovery rate of 378% in May, up from 323% in April. Mainland Chinese shoppers in Asia Pacific also showed continued acceleration, with recovery reaching 221% in May, up from 156% in April.

When analysing year-on-year growth, worldwide issued sales in-store like-for-like performance grew by +47% in May, up from +46% in April and +40% in Q1.

The momentum remained strong across all nationalities, with Mainland Chinese shoppers growing by +164% in May, up from +148% in April and +214% in Q1.

In Continental Europe, issued sales in-store grew by +19% in May compared to last year, driven by positive dynamics across all nationalities.

Mainland Chinese shoppers led this growth with a +39% increase in May. US shopper growth reached +21%, and GCC shopper growth reached +20%.

In Asia Pacific, issued sales in-store growth remained high at +134% in May compared to last year. Mainland Chinese shoppers led this growth at +272%, followed by Northeast Asia shoppers at +163% and Hong Kong and Taiwan at +92%. ✈

{All infographics: Global Blue}