Bussiness

Revolut offers bond trading to Irish customers

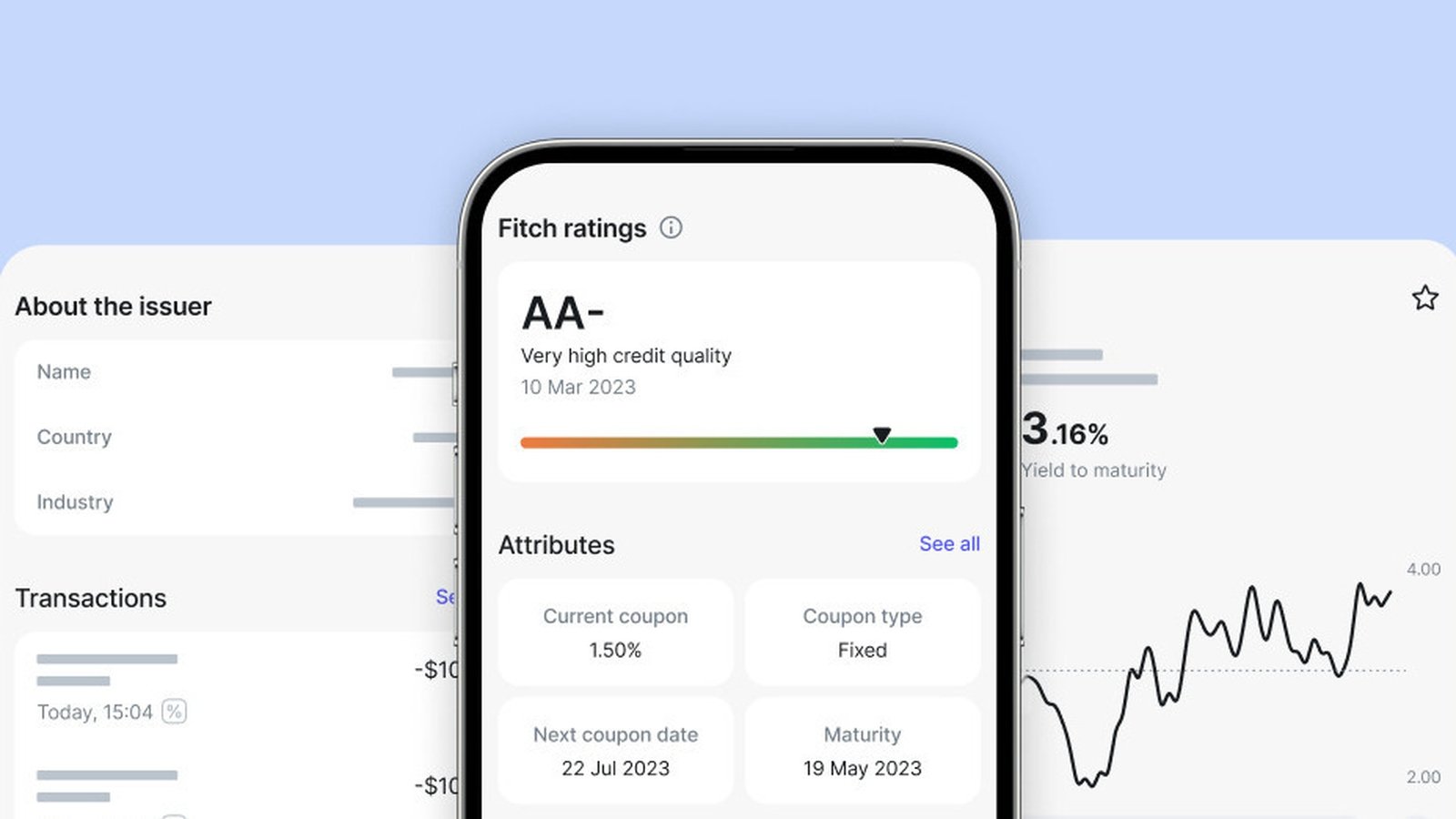

Financial app Revolut said today that it has added bonds to its investment offering in Ireland.

Revolut said it allows trading of almost 40 corporate and government bonds and will expand the list in the coming months.

The minimum amount to start investing in bonds is €100, with 0.25% fixed fee per trade (minimum €1). Revolut said that essentially, the fixed fee per trade is either 0.25% or €1, whichever is higher.

Other fees may apply, the financial app added.

Revolut said that bonds are a good starting point for people who tend to be more risk-averse, as they normally offer stability and great portfolio diversification.

It noted that good credit ratings and protection against inflation further contribute to their appeal for investors seeking stability and potentially reliable returns.

It added that different bond types offer various risk and return profiles, and they should be assessed accordingly, adding that bonds’ returns might also make them a good hedge in case of a wider economic downturn.

Revolut has more than 40 million customers worldwide, with over 2.8 million customers in Ireland. Last month it launched new instant access savings accounts with rates of up to 3.49% AER variable.

Maurice Murphy, General Manager at Revolut Bank UAB – Ireland Branch, said that bonds trading is just another way in which Revolut is solving all things money for its customers in Ireland.

“We expect this to be a very useful addition for those wishing to grow their wealth,” Mr Murphy said.

“Along with our recently introduced Instant Access Savings product and our automated portfolio management tool Robo-Advisor, Revolut remains a frontrunner in helping Irish people to grow their finances more broadly,” he added.