Travel

Sabre Market Intelligence Reveals Key Insights into China’s Outbound Travel Trends

(11/06/24)

According to Sabre market intelligence and

booking insights, Chinese tourists are back with a vengeance on

the global tourism stage, with a 392% surge in outbound travel

booked from mainland China for 2024, compared to the previous

year.

When you consider that pre-pandemic travellers

from China made 155 million international trips, collectively

spending to the tune of $245 billion, it’s little wonder that the

world has been waiting for China to re-enter the global tourism

market in a significant way.

However, with China slower to ease travel

restrictions in comparison to other countries, even after the

re-opening of borders, it hasn’t been a quick comeback.

The major

rebound of outbound Chinese travel that some expected in 2023

didn’t occur. That picture is rapidly changing in 2024, and what

is clear from Sabre’s analysis of industry data (which looks at

travel booked from mainland China as of 31 March 2024) is there

is a huge appetite among Chinese travelers for global travel.

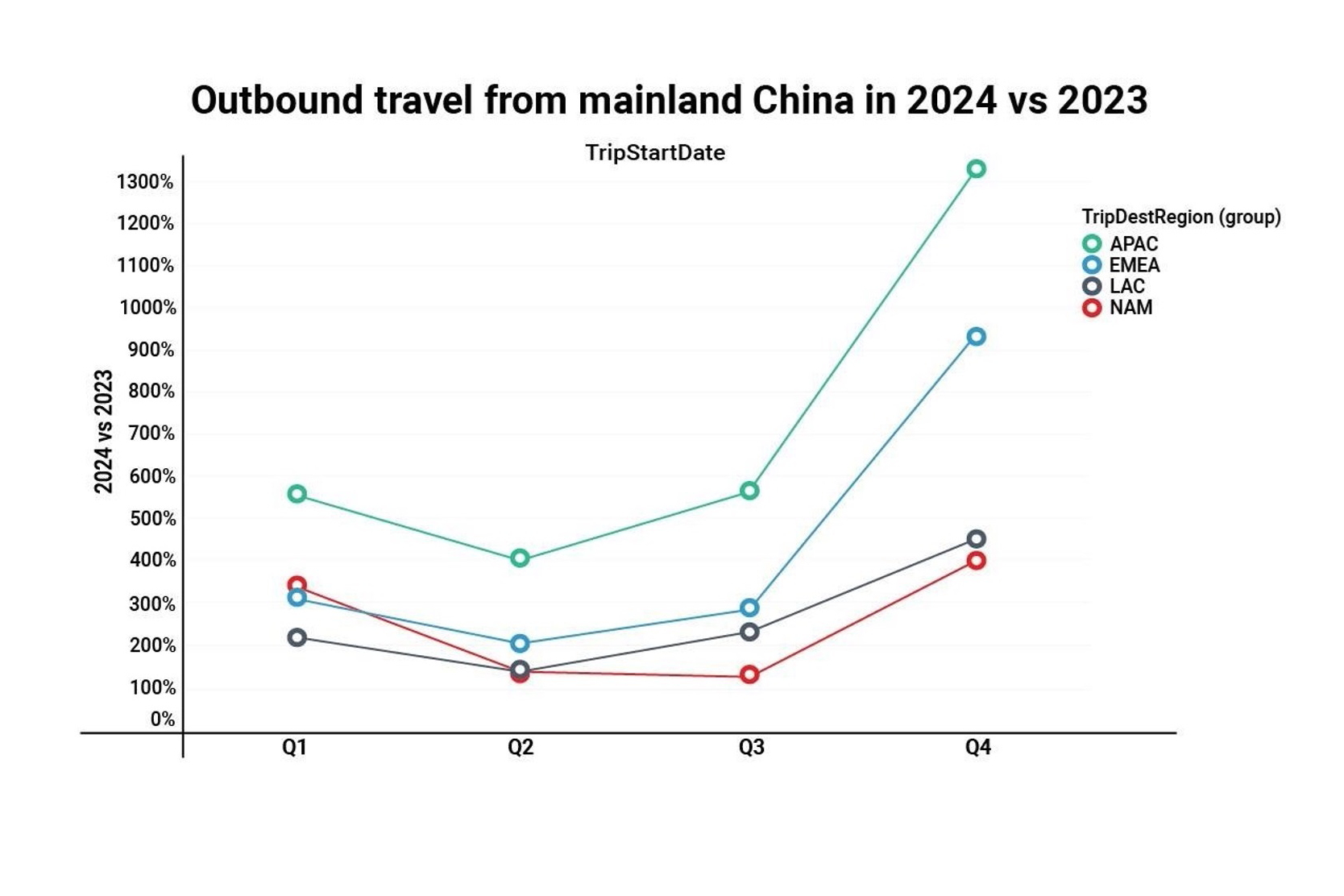

Outbound travel from Mainland China. Source: Sabre Market Intelligence

While outbound travel hasn’t rebounded to

pre-pandemic levels, bookings for travel to key parts of the world

during typical peak travel dates are seeing particularly strong

demand.

Bookings made at the end of January before the 2024

Chinese New Year break for travel from mainland China to countries

in the Asia Pacific region, for example, were at 106% of 2019

levels.

Sabre’s key findings include:

– Travel originating from mainland China has

increased by 392% overall globally for 2024, with some

destinations seeing surges of more than 2,000%;

– Chinese travelers are taking advantage of

reciprocal visa-free agreements with countries around the world,

but they aren’t limiting where they travel;

– Airfare prices are down, making travel more

affordable for Chinese travelers;

– Fastest growing routes

globally for Chinese travelers in 2024 include Macao, Australia,

Japan, Russia and Bangladesh;

– Chinese travelers are once again embracing

Business Class travel, and demand for Premium Economy travel is

also increasing; and

– Outbound airline capacity is up by more than

3000% on some routes as airlines look to meet demand.

Sabre’s industry booking data analysis shows that

the amount of travel originating in mainland China, either already

travelled or booked to travel during 2024 (up to 31 March 2024)

increased significantly compared to travel booked at the same

point by 2023, soaring by 392% overall.

Outbound travel to all global regions has markedly

increased across the year, according to Sabre’s analysis, which

looks at travel booked as of 31 March 2024.

Notably, Chinese

travelers are booking in advance for the whole year, showing

strong confidence in the travel landscape. Bookings for November

and December are significantly up across regions, recording more

than 1000% year-on-year for all regions, and notably, more than

2000% for those months for travel to Europe and the Middle East.

For travel to other countries in Asia Pacific

(APAC) from China, travelers are planning their trips well in

advance, with booking numbers showing large increases, when

compared to 2023, for the whole year. October, when the Golden

Week holiday period will fall, is recording the largest

year-on-year increase in bookings at 1347%.

Outbound travel from China to the Europe and

Middle East and Africa region (EMEA) peaked in the first quarter of the year,

in January with a 676% increase. There are again increases

throughout the whole year, with a significant year-on-year boost

in December.

For the Americas, travel to North America in the

first quarter recorded the second highest year-on-year growth,

after APAC, at 336%, and travel to Latin America is also

increasing throughout the year, with the most significant booking

increases for the final quarter of 2024.

New Favourites and Old Favourites Re-Visited

As Chinese travellers are renowned for being high

spenders when they travel, spending an average of $1,000 a day

during their trips, it will come as little surprise that a number

of countries around the world – including South Africa, Kenya,

Tanzania, Thailand, Indonesia, France and Saudi Arabia – have

launched initiatives in a bid to be their destination of choice.

While Chinese outbound travel is significantly

increasing overall, there have been destination changes in terms

of the most popular routes, when comparing 2023 to 2024, and then

looking at the percentage increase in travel booked to each

destination.

The top 10 most popular destinations for outbound

Chinese travelers are similar in 2024 compared to 2023. However,

Australia and Malaysia have moved into the top 10, with Australia

moving up seven places, and Malaysia moving from 18th to ninth,

while Canada and Spain dropped out. Korea and Japan rose in the

rankings to take first and second place respectively, pushing down

the US and Thailand.

In the top 30, there has been more movement when

compared to 2023. Travel from mainland China to Macao, which is

popular as a gambling hub, is also up significantly from 44th

place to 15th.

Meanwhile, Britain has moved from 22nd to 16th, and

Kazakhstan is up from 40th to 29th, with many tourists drawn to

its winter sports activities.

Bangladesh is also seeing an

increase to 30th place from 46th, which may be due to corporate

and visiting family travel, and the launch of new routes.

In Asia Pacific, the countries with the biggest

increases are Australia and Japan, with Australia moving from 8th

to 6th place in the region, and Japan from 5th to 2nd.

Australia

is aiming to be top of mind for Chinese travelers. Japan has two

cities in the top 10 when looking at a city perspective, while the

cities seeing the biggest travel booking increases are Macao and

Osaka.

Visa-Free Arrangements

Since the start of the pandemic, China was

essentially closed for both inbound and outbound travel. Since

January 2023, that has been changing rapidly, with visa-free

agreements continuing to evolve and expand into 2024.

China signed a mutual agreement on 30-day

visa-free travel with Singapore, which became effective from 9 February

2024, allowing entry for business, travel, leisure, and

sightseeing.

Thailand and China agreed to a similar arrangement,

effective 1 March to replace a temporary visa suspension which

ended in February. Thailand immediately felt the benefit of the

arrangement in 2023 but has dropped a little in the rankings as

more agreements come in place, giving travellers more choice.

Other recent announcements include a unilateral

15-day visa waiver pilot scheme for citizens from France, Germany,

Italy, Netherlands, Spain, and Malaysia, due to last until

November this year.

There is also a 15-day visa free entry scheme

for citizens from Switzerland and Ireland. In addition, China and Russia

resumed cross-border visa-free policies for tour groups, whilst China and

Georgia agreed to waive visa requirements for travelers, starting

28 May.

The agreements appear to be having an impact on

outbound and inbound travel, particularly for South East Asian

travel.

Singapore has seen a 466% increase in inbound

bookings from China, and a 461% increase for trips in the opposite

direction, when compared to 2023.

Travel from mainland China to

Malaysia has increased by 651%, and has enjoyed 886% increase for

travel from Malaysia to mainland China. Travel to Russia increased

by 758% and from Russia to mainland China by 677%.

However, travel to and from China certainly isn’t

limited to countries with visa-free arrangements. Chinese

travellers are embracing more flexibility to travel, even if they

need to apply for a visa on or before arrival.

Outbound travel and

bookings from mainland China to Australia, for example, are up

1,000%, while travel to Indonesia is showing a close to 600%

increase, Britain as a destination is up by 525%, and India is

enjoying a 520% increase.

Airlines are playing their part, increasing capacity to meet demand.

International capacity originating from China increased by 280%

year-on-year in the first quarter of the year, with the largest

increases coming from key hubs like Beijing, Shenzhen and Chengdu

which saw capacity increase by 400%, 560% and 3200% respectively.

These hubs also saw inbound capacity increase significantly by

400%, 560% and 3300%.

As capacity is increasing and supply and demand

are achieving greater equilibrium, fares for routes from mainland

China are priced lower across the board when compared to 2023,

making travel more affordable for Chinese travellers.

For Q1 2024 travel, the difference was up to -73% and -71% on key

routes, with the most significant decreases in fare cost being

from Shanghai to Seoul, and Shanghai to Tokyo.

Lower fare prices are seen across most of 2024

and, as bookings are made for 2025, Sabre is also seeing the trend

for lower fares continue into the new year.

Whilst fare prices are down, many Chinese

travellers are happy to pay more to elevate their travel

experience. Business Class travel is just fractionally below 2019

in terms of percentage of travel booked, at 3.6% for 2024,

compared to 3.7% for 2019. Although first class travel is down by

0.4%, premium economy travel is up by 0.8%, indicating

opportunities for airlines and agencies to cater to passengers who

want to upgrade their usual experience.

Embracing Global Travel Again

While 2023 was the year of re-opening for China,

Sabre’s research shows 2024 is the year Chinese travelers are

really embracing global travel again in significant numbers.

What

is important now is that the travel industry ensures it can deeply

understand what travelers from China want, where they want to go,

how they want to get there, and the experiences they want to have

when they reach their destination.

Those who really make the time and investment to

understand and deliver these needs will be the ones who win the

hearts, minds, and spending power of Chinese travellers in 2024,

and into the future.

When you consider that only around 13% of

Chinese citizens currently have passports, but increasing numbers

are applying for a passport with each passing year, the importance

of Chinese travelers for all sectors of the tourism industry can

only increase.

And, with Chinese travelers showing clear demand and

confidence in global travel for 2024, which is visible in Sabre’s

outbound travel insights, the tourism world is surely delighted to

welcome them back.

Latest

exclusive video interviews: 16

HD Video Interviews from Routes Europe 2024 in Aarhus, Denmark;

9 HD Video Interviews from Routes Asia 2024 in Langkawi, Malaysia;

Standard to Open Residences in Hua Hin and Phuket, Thailand; Video

Interview with Amar Lalvani, Executive Chairman;

9 Exclusive Video Interviews

from ASEAN Tourism Forum

2024

in Vientiane, Laos;

8 NTO Press Conferences from ASEAN Tourism Forum 2024 in

Vientiane, Laos;

13 HD Video Interviews from World Travel

Market 2023 in London, England;

5 HD Video Interviews from APG World Connect 2023 in Monaco, France;

15 HD Video Interviews from Routes World 2023 in Istanbul, Türkiye; and

Electric Airport Taxis at Almaty Airport (ALA) in Kazakhstan – HD

Video Interview with CEO.

Headlines: |